Payroll Management System for Educational Institutions

Perfect your payroll process with an easy, secure, cloud-based payroll software that’s loaded with automation to save your time, and ensure accuracy, and worry-free compliance.

Payroll confidence begins with Creatrix

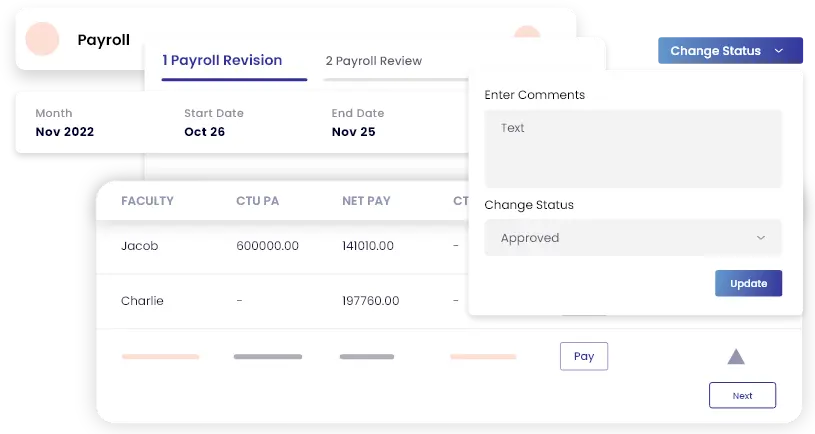

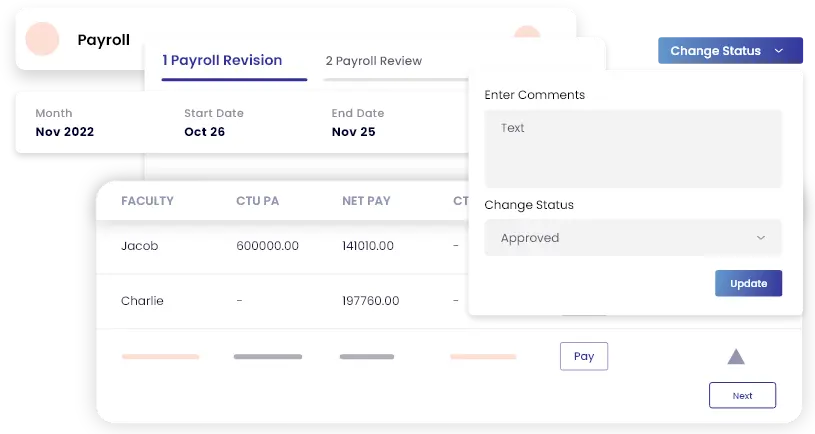

Process weekly, biweekly, and monthly payrolls in simple steps, allowing you to pay employees quickly and efficiently. Accommodate a variety of compensation structures, create multiple salary slabs for individual employees, and generate online payslips.

Monitor various statutory compliances, such as EPF, IT, PT, ESI, PF, LWF, and so on. Do incredibly rapid corrections with no need to restore data or reprocess pay runs; simply make the changes and they will be reflected in the next pay run.

Do more with Creatrix:

- Maintains compliance with State and Federal Regulations

- Access to tax professionals to ensure compliance

- LOP, bulk earnings, and deductions made simple

Lightning fast rules configurations

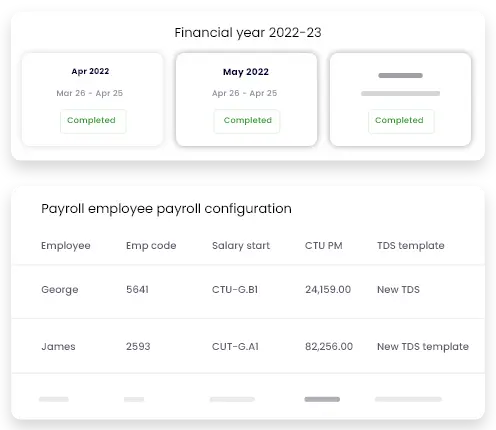

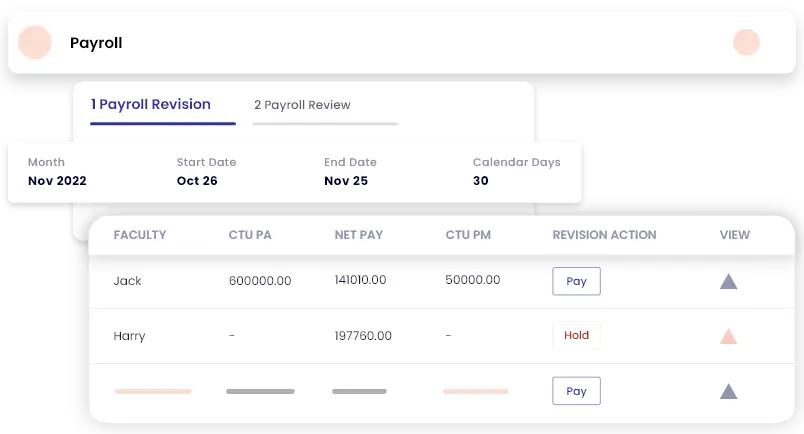

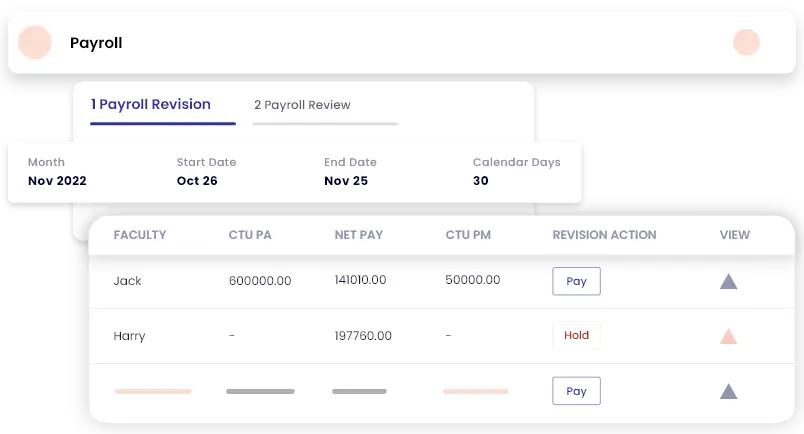

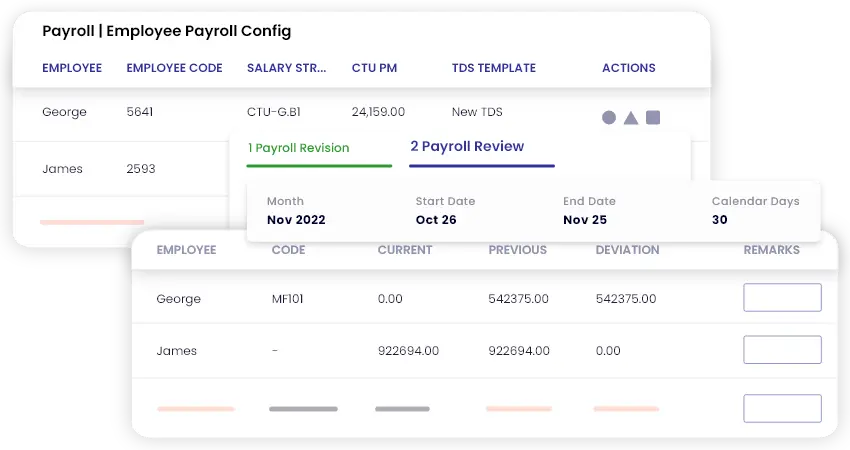

Gives finance team the key to configure multiple salary structures for hassle-free payroll processing. Input rules to hold/release employee salary, monitor bonus structure, overtime, and holiday bonuses.

Creatrix’s intelligent hr payroll management software is capable of deducting accurate tax amounts during each pay run in an automated manner. Organizations can create recurring or one-time profiles to handle all mandatory payrolls.

Do more with Creatrix:

- Create password-protected, secure payslips

- Define access controls for PDF payslip downloads

- Automated gratuity settlement for employees

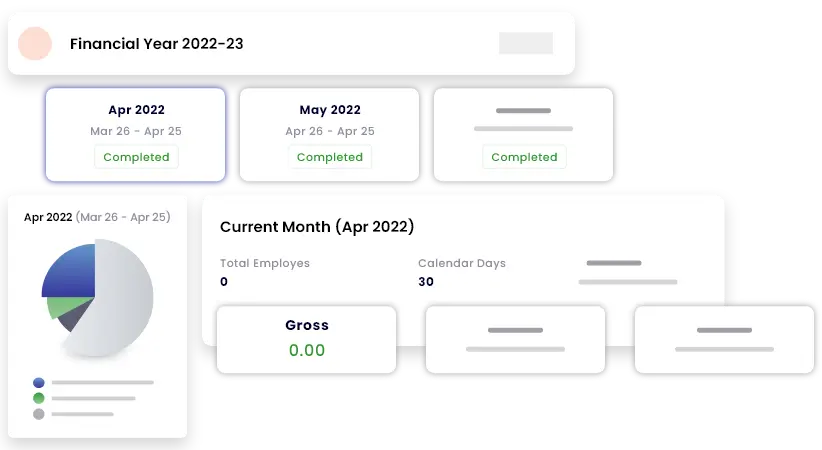

For the aerial payroll view

Gain better visibility into payday countdown, period end, upcoming deadlines when payroll is locked and completed, and key reports using dashboards. Track down invoices, estimates, expenses, tasks, and time in one place.

Quickly approve expenses, timesheets, and leaves, add new employees, and complete payroll tasks. Gain access to strong online tools like an employee self-service portal, an automated cloud backup, and payroll submission and approvals.

Do more with Creatrix:

- Fast report generation on payroll and HR data

- Quickly share information about payroll and personnel

- Direct self-service access to tax, PF, PT, ESI, and LWF

Reduce payroll errors

Use Creatrix payroll system to get rid of error-prone manual processes and workarounds. Capture precise data using a variety of time capture options that confirm an employee's identity.

Optimize every pay rule for consistent and accurate payment every time. Streamline approval processes and send out proactive notifications to address urgent issues like no-shows, unplanned overtime, and more.

Do more with Creatrix:

- Track workforce's salary-related history meticulously

- Year-round record keeping for reduced payroll costs

- Thorough checks for unfinished forms, unpaid taxes