5 ways to turn college startups into a recurring revenue machine

Starting a college project is fascinating; nevertheless, maintaining profitability is quite another matter. Many college businesses find it difficult to maintain revenue growth between increasing running expenses, administrative inefficiencies, and erratic cash flow. Actually, cash flow issues cause 82% of small firms to fail; education startups are not an exception.

The fix? smarter, data-based ideas for college recurrent income. Supported by actual data, let's explore five tested strategies to make your college startup a revenue-generating machine.

Five Data-Based Strategies for College Recurring Revenue to Increase Profits

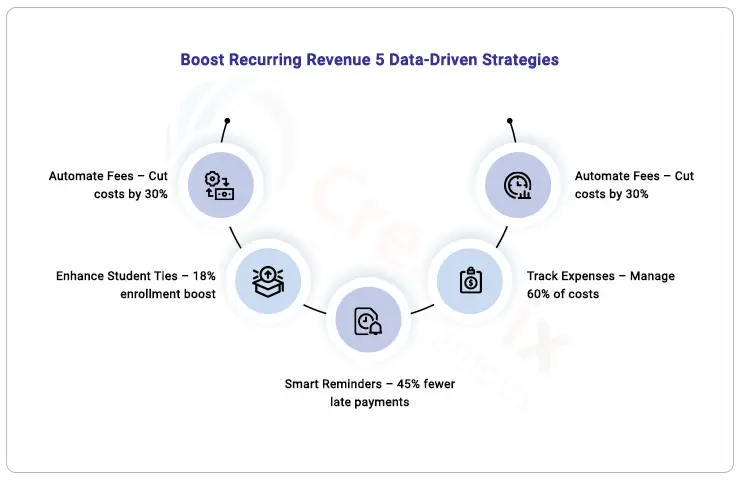

1. Automate Fee Collection: Save Up to 30% of Costs

Unbelievably, mistakes in manual fee processing could cost organizations up to 25% of their whole income. Automating your fee collecting guarantees faster payments, less billing errors, and simplifies the process. Studies reveal that companies implementing automation cut their running expenses by thirty percent; consider what that could mean for the financial situation of your college.

Using a cloud-based fee management solution can help you to automatically handle receipts, cut manual invoicing, and send quick payment reminders.

2. Strengthener student relationships – boost enrollment by eighteen percent

Automate Fee Collection: Save Up to 30% of Costs

Unbelievably, mistakes in manual fee processing could cost organizations up to 25% of their whole income. Automating your fee collecting guarantees faster payments, less billing errors, and simplifies the process. Studies reveal that companies implementing automation cut their running expenses by thirty percent; consider what that could mean for the financial situation of your college.

Using a cloud-based fee management solution can help you to automatically handle receipts, cut manual invoicing, and send quick payment reminders.

3. Smart Reminders & Communication — 45% Less Late Payments

Weary of hunting payments? When institutions deliver timely SMS, email, and push notifications, a shockingly 45% of late fees are paid within a week. Automated reminders guarantee parents and students never miss a deadline, therefore reducing late payments and improving cash flow.

To expedite collections and save administrative expense, schedule automated reminders for due dates, past-due penalties, and payment acknowledgements.

4. Control Your Spending Track About sixty percent of operational expenses

Unchecked expenses cause colleges to bleed money; but, systematic expense tracking helps to control 60% of operational costs. Institutions can recognize early overspending, maximize resource allocation, and increase profitability by real-time cost capture and manual expenditure entry elimination.

Use cost control tools to oversee vendor payments, check program budgets, and guarantee every dollar counts.

5. Improve Real-Time Data Insights to Increase Revenue 20%

Think about predicting financial constraints. Data analytics boosts revenue by 20% for institutions tracking revenue, costs, and student performance. Late payments, course profitability, and untapped income potential are visible in real time dashboards.

With a real-time performance metrics dashboard, track cash flow, find income trends, and improve financial agility.

Ready to Turn Your College Startup into a Revenue Powerhouse?

The path to a sustainable, recurring revenue model isn’t about working harder — it’s about working smarter. By embracing automation, student relationship management, expense control, and data-driven decision-making, your college startup can maximize revenue, minimize costs, and scale faster than ever.

Ready to future-proof your revenue strategy? Let Creatrix Campus help you build a smarter, more profitable institution — starting today.